Key Highlights

- Nvidia’s share of China’s AI GPU market has dropped from 95% to zero due to U.S. export controls.

- The Chinese market previously accounted for 20-25% of Nvidia’s data center revenue.

- Nvidia CEO Jensen Huang stated that the company is now assuming no revenue from China in its forecasts.

- China has increasingly turned to domestic silicon or alternative hardware due to export curbs.

The Impact of U.S. Export Controls on Nvidia’s Chinese Market

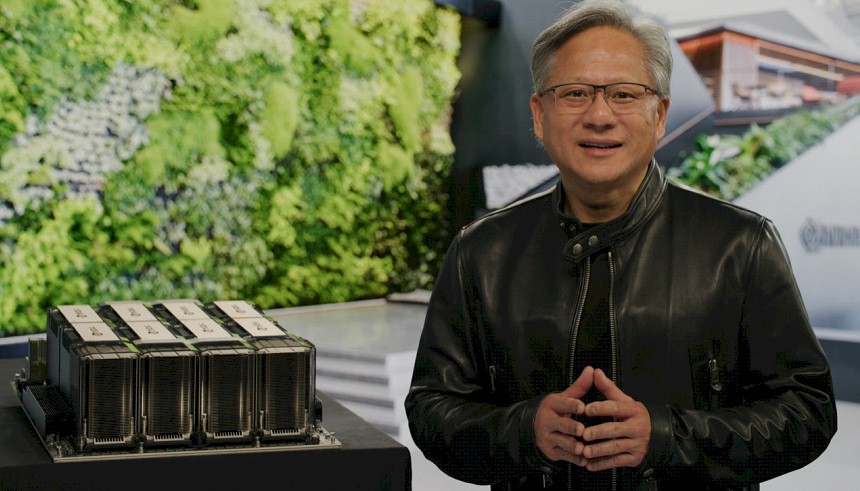

Nvidia, a global leader in artificial intelligence (AI) and graphics processing units (GPUs), recently announced that its share of the Chinese AI GPU market has plummeted from 95% to zero due to stringent U.S. export controls. Speaking at the Citadel Securities’ Future of Global Markets 2025 event on October 6, Nvidia CEO Jensen Huang highlighted this significant shift in the company’s business landscape.

Quantifying the Scale of Nvidia’s Retreat

Huang emphasized that the Chinese market once represented a substantial portion of Nvidia’s data center revenue. According to him, China accounted for between 20% and 25% of the chipmaker’s data center revenue, with this segment generating over $41 billion in revenue during its most recent financial results.

“At the moment, we are 100% out of China,” Huang declared. “We went from 95% market share to 0%.” This dramatic decline underscores the severe impact of U.S. export controls on Nvidia’s global business strategy and highlights the challenges posed by geopolitical tensions in the technology sector.

Domestic Innovation and Localization Efforts

The U.S. government has implemented these export restrictions as part of a broader strategy to limit China’s access to advanced semiconductors, which are crucial for AI development. However, Huang’s remarks reveal how quickly the market dynamics have shifted on the ground. “I can’t imagine any policymaker thinking that’s a good idea, that whatever policy we implemented caused America to lose one of the largest markets in the world to 0%,” he stated.

In response to these export curbs, China’s hyperscalers and AI labs have increasingly turned to domestic silicon or alternative hardware. This trend towards localization is accelerating as companies seek to reduce reliance on foreign technology. Huang has previously warned that such blanket restrictions could spur the development of competitive substitutes, a scenario that appears to be unfolding.

Implications for Nvidia’s Future in China

Nvidia’s cautious guidance reflects the uncertainty surrounding its future operations in China. “In all of our forecasts… we’re assuming 0% for China,” Huang said. “If anything happens in China… it will be a bonus.” This strategy indicates that while Nvidia is writing off the Chinese market for now, there remains hope for potential returns in the future.

Industry experts suggest that this shift could have far-reaching implications beyond just Nvidia’s business model. The broader semiconductor industry may face significant changes as companies adapt to new geopolitical realities and work towards reducing supply chain vulnerabilities.

Conclusion

The rapid decline of Nvidia’s market share in China due to U.S. export controls highlights the complex interplay between technology, geopolitics, and business strategy. As more countries and companies seek to localize their tech infrastructure, the semiconductor industry is likely to undergo substantial transformation. For Nvidia and other tech giants, navigating these challenges will require innovative solutions and strategic adjustments to stay competitive in a rapidly evolving global landscape.